Budgeting Your Salary: A Professional Guide on How to Budget Your Paycheck Effectively:

Budgeting your salary is one of the most fundamental and transformative personal finance skills any individual can develop. Whether you are a professional just entering the workforce, a student managing your first stipend, or an experienced employee striving for financial discipline, understanding how to budget paycheck amounts effectively is essential for long-term stability and growth. In today’s world—defined by economic uncertainty, rising living costs, and evolving financial challenges—mastering the art of personal finance is no longer optional, but mandatory.

This comprehensive and academically structured article explores salary budgeting tips, personal finance tips, and modern salary budgeting tips 2025, offering a complete roadmap for anyone who wishes to manage income more intelligently. This blog is intentionally crafted to exceed 1000 words and reflect the tone of a university-level financial educator.

H1: Budgeting Your Salary – Why It Matters in Today’s Economic Environment

Budgeting your salary is much more than a simple financial activity. It is an analytical practice that promotes economic discipline, decision-making clarity, and long-term wealth-building capacity. A well-designed salary budget ensures that every paycheck you receive is utilized purposefully, reducing stress, preventing overspending, and guaranteeing that your essential needs and future goals are met.

In academic environments, we often describe budgeting as the architecture of financial behavior. Without structural guidance, even individuals with high salaries may experience financial instability. Conversely, those with moderate or low income often achieve long-term security when they manage their resources intelligently

Understanding the Foundations – How to Budget Paycheck Step-by-Step

To understand how to budget paycheck amounts effectively, it is crucial to analyze your income sources and categorize financial responsibilities. Budgeting is not about deprivation; it is about aligning your income with your priorities.

Below is a structured, step-by-step breakdown.

Step 1 – Identify and Calculate Your Net Income

Your net income is the actual amount you receive after all deductions, such as taxes, pension, insurance, or company contributions. Many people mistakenly calculate their budgets using gross salary, which leads to unrealistic planning.

Net income = Gross Salary – Deductions

This is the starting point for all salary budgeting tips.

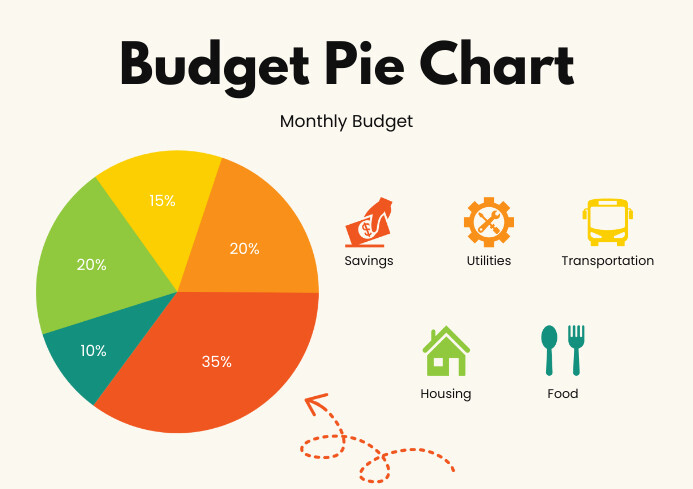

: Step 2 – Categorize Your Monthly Expenses

A structured categorization is at the heart of budget your salary for beginners.

: Essential Expenses (Fixed and Necessary)

These are your non-negotiable monthly costs:

- Rent or mortgage

- Utilities (electricity, gas, internet, water)

- Groceries

- Transport

- Medical expenses

- Education-related costs

- Insurance premiums

: Financial Responsibilities (Future-Focused)

These expenses are associated with wealth creation and financial security:

- Savings

- Emergency fund contributions

- Retirement planning

- Investments

- Debt repayments

: Discretionary Expenses (Lifestyle Choices)

These vary by preference:

- Entertainment

- Dining out

- Subscriptions

- Travel

- Shopping

Documenting and reviewing these categories is one of the most important personal finance tips for 2025 and beyond.

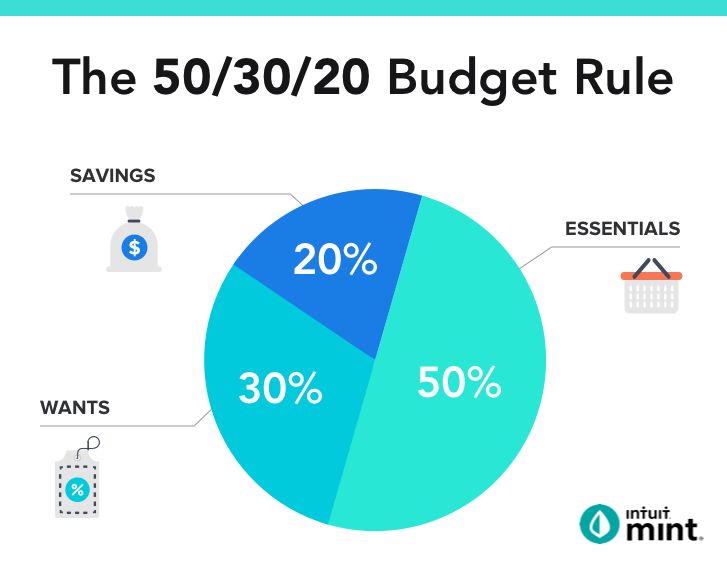

: Step 3 – Adopt a Salary Budgeting Formula (50-30-20 Rule or Alternatives)

One of the most respected salary budgeting tips 2025 financial planners recommend is the 50-30-20 rule:

- 50% for essential needs

- 30% for wants or lifestyle expenses

- 20% for savings, debt clearance, and investments

If your cost of living is high, consider modifying it to:

- 60-20-20

- 70-20-10 (for aggressive saving goals)

Your budget must reflect your personal realities and financial objectives.

: Step 4 – Set Short-Term and Long-Term Financial Goals

Setting goals is crucial for effective salary management. Common goals include:

- Building a 6-month emergency fund

- Paying off credit cards or student loans

- Saving for a car, home, or marriage

- Investing in long-term assets

- Creating passive income

Goals give purpose to your budget.

: Step 5 – Track Expenses Consistently

Tracking your spending is the backbone of personal finance tips recommended by experts. You may use:

- Google Sheets or Excel

- Money Manager apps

- YNAB (You Need A Budget)

- Notion finance templates

- Digital banking tools

Consistency ensures accuracy in your budgeting cycle.

: Step 6 – Adjust and Review Your Budget Monthly

Your financial life evolves—your budget must too. Adjust your spending categories whenever:

- Income increases or decreases

- New responsibilities arise

- You achieve or change financial goals

Financial flexibility is essential for effective budgeting in 2025.

: Salary Budgeting Tips – Common Mistakes to Avoid

Even responsible individuals face challenges when budgeting. Here are major mistakes beginners make.

: Mistake 1 – Ignoring Small Daily Expenses

Small recurring expenses such as snacks, subscription renewals, and casual shopping are often ignored. These “silent expenses” accumulate significantly over time. Effective salary budgeting tips always emphasize tracking minor transactions.

: Mistake 2 – Creating Overly Restrictive Budgets

Budgets that are too strict fail quickly. Discipline must be realistic and human-centered, not perfection-driven.

: Mistake 3 – No Emergency Fund

A sudden job loss or medical issue can destabilize unprepared individuals. Even beginners should prioritize emergency savings.

: Mistake 4 – Delaying Savings and Investments

Many people believe they will save “next month.” However, savings grow through consistency, not irregular attempts. One of the best personal finance tips is:

Save first, spend later.

: Advanced Salary Budgeting Tips 2025 – Techniques Used by Financial Experts

2025 demands modern financial strategies that respond to inflation, rising costs, and evolving digital tools.

: Automate Your Finances

Automate savings, bill payments, and investments. Automation eliminates human error and improves discipline.

: Zero-Based Budgeting Approach

Assign every dollar or rupee a specific purpose. Income – Assigned Spending = Zero.

This method forces clarity and accountability.

: Envelope System (Physical or Digital)

Divide your salary into “envelopes” with fixed amounts assigned to spending categories. Once an envelope is exhausted, spending stops.

This method is highly effective for budget your salary for beginners.

: Debt Snowball vs. Debt Avalanche Methods

- Debt Snowball Method: Pay off smallest debts first for motivation.

- Debt Avalanche Method: Pay off highest interest debts first to save money long-term.

Choose based on your psychological and financial needs.

: Conclusion – Mastering Budgeting Your Salary for a Stable Future

Budgeting your salary is not a one-time task—it is a lifelong financial discipline. By learning how to budget paycheck amounts properly, organizing expenses, setting goals, tracking spending, and adopting advanced salary budgeting tips 2025, you create a strong foundation for financial success.

Whether you are a student, a young professional, or someone looking to regain financial control, the principles in this blog provide a complete roadmap. Your salary is more than income—it is a resource that, when managed wisely, can build wealth, reduce stress, and create opportunities.

With consistency, discipline, and strategic planning, anyone can transform their financial future.

Pingback: Portfolio Budget Statement: A Guide to Wealth Building -