Discover top money building assets, strategies to grow wealth, and tips to achieve financial freedom. Learn practical steps to build long-term wealth today!

Money Building Assets

Introduction

Building wealth in the modern economy requires more than simply generating income at an accelerated pace; it means using that income to invest in (build) wealth through the creation of money building assets (wealth generators). Money building assets are essential for achieving financial freedom, stability, and independence. The following article will provide information on the best money building assets available today, as well as strategies for investing your money wisely and building a solid financial foundation for the future.

1. What Are Money Building Assets?

Assets that Build Wealth Create wealth-generating (money-generating) assets or income-producing assets are things/assets/financial resources that produce income for their owners or that appreciate in value over time. Money-draining liabilities also exist however, as with all assets as are money-generating assets.

- Any money-generating asset may include, for example:

- The value of your ownership/interest in Real Estate will appreciate (grow) over time.

- Ownership in companies that pay dividends or increase in value (e.g., stocks).

- Ownership in Government Bonds, which provide a stable investment, producing regular interest income.

- Businesses generate recurring revenue through the production of profits.

- Digital assets, such as websites, online businesses, or other digital products (such as digital downloads) create a stream of passive income.

Bonus Tip: It’s important to find money-generating assets that fit your risk profile (risk tolerance) and long-term financial goals.

2. Why Building Assets Is Important

Asset Creation Affects More Than your Wealth, It Gives You Financial Stability And Freedom.

- Passive Income – A Way to Create Income without Continuing To Work.

- Asset Appreciate Faster Than Inflation

- Enhanced Wealth Value – Will Increase Your Net Worth over Time

- Financial Independence – You No Longer Need A Job To Survive As You Build An Asset Base.

3. Top Money Building Assets to Invest In

1: Real estate:

Investing in Real Estate has been a long-standing and widely accepted way to accumulate wealth over time. You can generate income through rent and the rising value of your property along with tax advantages associated with investing in Real Estate. .

Tips to get started with Real Estate:

- Start investing in high-demand rental real estate.

- If you have limited funds for investment you should look into buying REIT’s.

2: Stocks & Shares

Stock and shares are equity-based investment vehicles that have the potential to build large amounts of financial wealth over time by investing long term in strong companies.

Tips to invest in Stock and Shares:

- Diversifying across industry sectors will reduce risk.

- Reinvesting dividends will lead to greater growth potential.

3: Bonds and Fixed Income Investments

If you are looking for an investment that is stable, low-risk, and has a predictable stream of payments, you may want to consider Bonds and other types of Fixed Income Investments. These investment choices are well suited for conservative investors who prefer a steady stream of income.

4: Businesses and Startups

Starting and owning a business gives you the opportunity to earn the maximum amount of money possible, in addition to providing you with control over your financial future.

Tips for starting a Business or Startup:

- Seek ways to create automated, scalable businesses.

- Create an online business so you can reach a large, worldwide market.

5: Digital Assets

In today’s digital world, there is opportunity for passive income through digital assets such as blogs, eBooks and video channels.

Tips for creating Digital Assets:

- Create content that attracts a steady flow of website visitors.

- Monetize through advertising, sponsorships and/or selling products.

4. Strategies to how to grow money Building Assets

- A well-diversified portfolio is comprised of many different investment types (asset classes) in order to reduce overall risk to an investor.

- Profits from investments should be reinvested by purchasing additional investment assets.

- Investors should educate themselves about how the investment market operates, as well as current and future investment opportunities.

- Investing as early as possible will allow you to take advantage of the time factor in accumulating wealth.

- Monitor your investments on a consistent basis to maximize the potential for growth.

5:Typical Errors That Should Be Avoided:

- Neglecting Risk Management – Attributing all of your money to high-risk assets is unwise.

- Short-Term Thinking – Wealth accumulates over decades; therefore, avoid looking for fast, high-maintenance profits.

- Disregarding Research – All investments should be thoroughly understood.

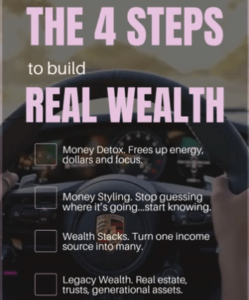

6: Steps to Building Wealth with Money-Building Assets:

- Make small, controllable investments initially.

- Choose assets that support your long-term objectives.

- Seek information about asset classes through online tools, courses, or professional financial advisors.

- Monitoring and measuring your net worth and asset performance on a regular basis.

FAQs About Money Building Assets

Question 1: For a beginner, what is the most ideal asset type?

Answer: Stocks and exchange-traded funds (ETFs) are the two best beginner investment vehicles due to their low capital requirements and potential for appreciation over time.

Question 2: How much capital do I need to invest?

Answer: Investing with as little as $50-100 monthly can result in considerable growth over time with ongoing investment.

Question 3: Can digital assets truly provide passive income?

Answer: Digital assets can generate passive income! After establishing a website, online courses, or YouTube channel, you can continue to earn income from them.

Question 4: How long will it take to create significant wealth with investing in assets?

Answer: Generally, it will take 5-10 years of prudent investing for you to see significant results depicting an increase in wealth.

Pingback: What is Wealth Creation? Simple Guide to Financial Freedom -